Higher Education Textbooks & Solutions

McGraw Hill Asia is focused on delivering value-added learning solutions. We empower instructors and help every student succeed by providing access to high quality, engaging and affordable course materials.

Overview

Fundamental Accounting Principles and Principles of Financial Accounting 3rd edition continues to provide leading accounting content that engages and motivates students. With its step-by-step approach, these books streamline complex accounting processes and help students build confidence by mastering key concepts and procedures.

Suitably written for both introductory and intermediate courses in Accounting Principles and Principles of Financial Accounting guided by international accounting standards, this edition helps students develop good decision-making habits as they prepare, analyze, and apply accounting information. It also includes the latest available financial reports of Nestlé and Adidas, both multinational companies that comply with international standards in accounting to further reinforce the real-world relevance of accounting concepts.

Hear from our Author

Print: 9789814923378

eBook: 9789814923330

Connect: 9789814923392

- Accounting in Business

- Analyzing and Recording Transactions

- Adjusting Accounts for Financial Statements

- Completing the Accounting Cycle

- Accounting for Merchandising Operations

- Inventories and Cost of Sales

- Accounting Information Systems

- Cash, Fraud, and Internal Control

- Accounting for Receivables

- Long-Term Assets

- Current Liabilities and Payroll Accounting

- Accounting for Partnerships

- Accounting for Corporations

- Long-Term Liabilities

- Investments

- Reporting the Statement of Cash Flows

- Analysis of Financial Statements

- Managerial Accounting Concepts and Principles

- Job Order Costing

- Process Costing

- Cost-Volume-Profit Analysis

- Master Budgets and Planning

- Flexible Budgets and Standard Costs

- Performance Measurement and Responsibility Accounting

- Relevant Costing for Managerial Decisions

- Capital Budgeting and Investment Analysis

Print: 9789814923385

eBook: 9789814923347

Connect: 9789814923392

- Accounting in Business

- Analyzing and Recording Transactions

- Adjusting Accounts for Financial Statements

- Completing the Accounting Cycle

- Accounting for Merchandising Operations

- Inventories and Cost of Sales

- Accounting Information Systems

- Cash, Fraud, and Internal Control

- Accounting for Receivables

- Long-Term Assets

- Current Liabilities and Payroll Accounting

- Accounting for Partnerships

- Accounting for Corporations

- Long-Term Liabilities

- Investments

- Reporting the Statement of Cash Flows

- Analysis of Financial Statements

Table of Contents

What's Inside?

- Features

- Connect

- SmartBook 2.0

- Assignable End of Chapter Materials

- Comprehensive Test Bank

- Connect Reports

Fundamental Accounting Principles and Principles of Financial Accounting 3rd edition is written to enhance students’ mastery and application of concepts to real-world applications.

- The recognition, measurement, disclosure, and reporting of revenues, receivables, and investments follow the guiding principles of international accounting standards

- Extensive coverage of Environmental, Social, and Governance (ESG) reporting by leading Asian companies

- Management accounting practices showcase innovative Asian companies

- A unique pedagogical framework that gives insight into every aspect of business decision-making supported by accounting information

- Conceptual/Analytical/Procedural (CAP) model allows instructors to easily customize their courses

- Chapter-opening stories featuring businesses from diverse sources

- Useful points, hints, and tips strategically placed inside margins

- Comprehensive end-of-chapter questions, exercises, and problems

Fundamental Accounting Principles and Principles of Financial Accounting is available with Connect Accounting. Connect is an award-winning digital teaching and learning solution that enables students to attain better grades and allows instructors to improve course management.

It allows instructors to deliver, personalize and manage your course with ease. Connect can integrate with your learning management system to provide a seamless experience for both instructors and students.

SmartBook 2.0 personalizes learning to individual student needs, continually adapting to pinpoint knowledge gaps and focus learning on concepts requiring additional study. For instructors, SmartBook tracks student progress and provides insights that guide teaching strategies and advanced instruction, for a more dynamic class experience.

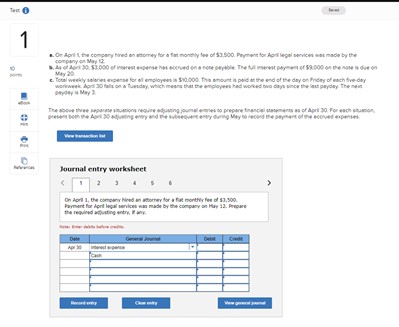

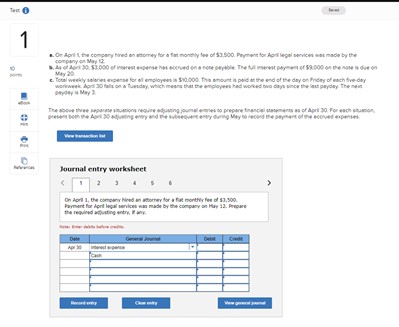

Assignable and gradable end-of-chapter content helps students learn to apply accounting concepts and analyze their work in order to form business decisions.

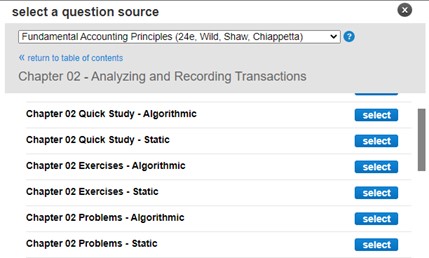

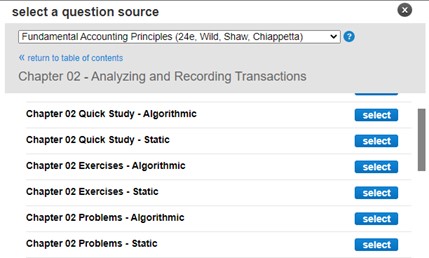

Connect includes a comprehensive test bank of various question types, allowing the instructor to create auto-graded assessment material with multiple problem types, algorithmic variation, and randomized question order.

Connect offers customizable reports on student performance, learning outcomes, at-risk students, and integrates easily with LMS gradebooks.

Contact Us Today

Whether you’re looking for a Connect demo, sample copy or have some questions for our Education Consultant – this is the form for you. Complete the form below and we’ll get in touch with you as soon as we can.